When creating a budget, trying to cut down your monthly costs, or deciding if you can actually afford to move to a new city, you need to calculate your living expenses. But calculating and tracking your personal and shared finances can be hard work. And let’s be real, we were never taught how to budget in high school.

But luckily, nowadays, there are many easy ways to calculate our current living expenses, compare them to the living standard and cost of living elsewhere, and make our own personal budget. So here is everything you need to know about calculating the cost of living and making a budget.

The new Together Price app, on Android and iOS, helps you track and split shared finances, making calculating your monthly cost of living hassle-free, and helping you split costs equally between groups, your household, or family.

So sign up to Together Price for free today and take the pain out of shared expenses!

How To Calulcuate Living Expenses and Make a Budget

When trying to stay out of debt, start saving, and have an emergency fund for things such as unexpected medical costs, budgeting makes a huge difference. By creating an accurate budget based on your current standard of living and monthly costs, you are able to plan more accurately and realistically for the future.

But making a budget can be difficult and it can be difficult to remember all the different categories of costs and services that you have to pay for on a monthly basis.

Calculate Your Monthly Expenses

These are some of the costs the average household in this country needs to take into account in order to calculate an accurate budget.

Housing Expenses

Housing expenses include things like rent, the cost of utilities, household taxes, or a mortgage if you have one. As a single person housing is likely to cost more as you are not able to share the cost of living with others, so you will likely spend a bigger portion of your income on the rent or mortgage.

The cost of rent, utilities, taxes, and a mortgage change vastly depending on the areas and cities you are living in. Using cost of living indexes you can see an estimate of the difference in housing costs when living in different cities across the country. For example, housing costs in San Francisco will be, on average, considerably more expensive than living in a different city such as Hot Springs Arizona. This also holds at a local level within different metro areas.

Transportation costs

To understand fully the cost of living on a monthly basis, you need to take into account your transportation costs. This involves things like the cost of your car, public transportation, car insurance premiums, gas, and also things like taxis and Uber if you spend money regularly on those.

Health Care Costs

In the US, health care costs are substantial. That means to be able to comfortably afford to use and access medical care and medical services, you need to be able to cover medical costs. That involves health care insurance premiums, deductibles, copayments, and coinsurance.

If you have a family you can often take out a family health care insurance plan that will cover the adults and children in a family. But, especially with a family, you will need to have an emergency fund in place and planned into your budget to be comfortable paying for health care services.

Education Costs

If you or your children are in education, you will need to consider education costs in your budget. That includes college fees, school supplies, school lunches, etc.

If you are a single adult in college with a child you will also need to consider the costs of child care.

Personal expenses & Food Costs

This category includes all your other additional costs. Some of these will be basic necessities such as groceries and food costs, and personal care expenses. Most people, if they have a sufficient income, will also spend money on things like Starbucks, a trip to the cinema, a night out, going out for food, or even holidays, miscellaneous items, and new clothes.

If you are regularly spending money on these things then make sure to add them to your cost of living data, as these will need to be included in your budget.

Calculate Your Monthly Income Level

To make a budget you will need to know how much your monthly income is so that you know how much money you have to spend.

If you are looking to move to a new city you can use labor statistics, tax data, and the cost of living index to see the average income in a specific area. That way you can make a budget that will fit your projected income in the new place.

When calculating your income you need to consider the following.

Take-Home Pay

Knowing your wage is not enough. You need to know exactly what your take-home pay is. This is your pay after taxes have been taken out.

Other Income

There are other types of income you might also need to include, for instance, if you own a house you might be paid rent. Depending on your family types and setup, you might receive an income to help raise your children, or you might get regular help from parents. You also need to include income from stocks etc.

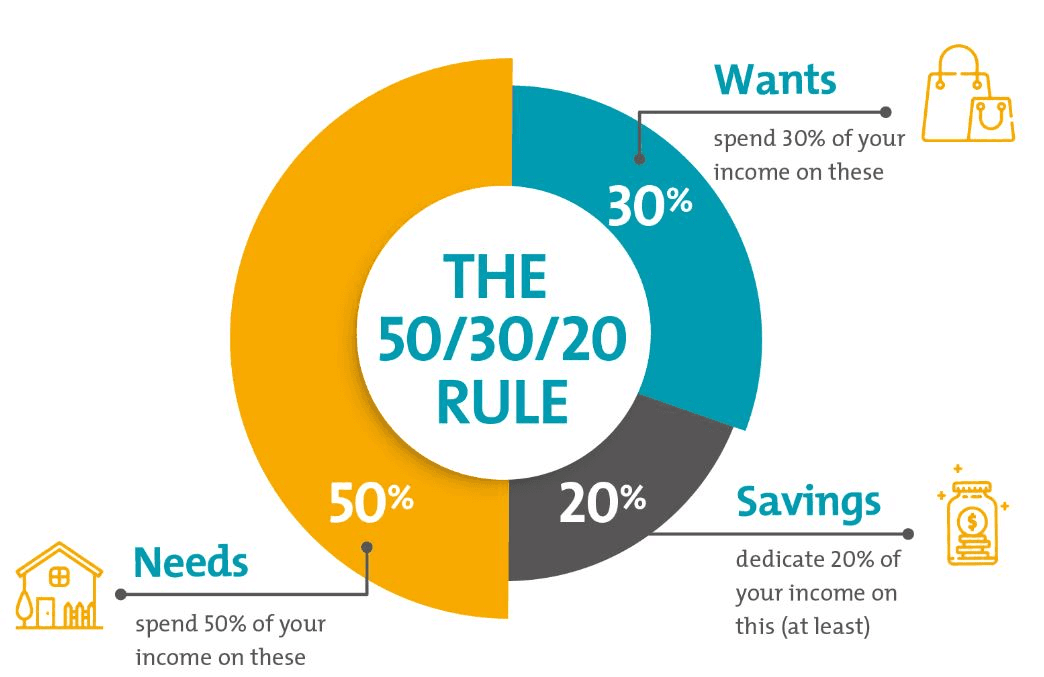

Use The 50/30/20 Budget Rule

Once you have all the data you need about your expenses and income, you can start to make a budget. One common budgeting rule is the 50/30/20 rule. This suggests that you break down your costs into three categories.

Spend 50% of your income on necessary expenses. These are your needs and include things like housing, taxes, food, transportation, child care, etc.

Spend 30% of your income on wants. For example, going to the cinema, keeping up with fashion, and getting a Starbucks. It is not always easy to distinguish the difference between wants and needs, but these are the things you do not need for survival.

Spend 20% of your income on savings. Whether you put these into a savings account, a retirement fund or make an emergency fund, by spending 20% of your income directly into savings you are building towards a financially stable future.

Use A Cost of Living Calculator Based on Community and Economic Research

If you are looking to move to a new place but are not sure whether you can afford it, using a cost of living calculator can be very useful.

These use data from a local level as well as the national average to calculate the cost of living in specific cities and areas. The US Bureau of Labor Statistics publishes a consumer price index, this is essentially a cost of living index. There is no official cost of living index published by the US government, but the Bureau of Labor Statistics gives us enough information to calculate an accurate estimate of the cost of living in different areas.

You can break down the cost of living in a different city into different categories including the cost of housing, taxes, child care, and additional children, as well as how much you can expect to be spending on food, transportation, and personal care costs. You can compare the wage you would require to meet the current standard and the cost of living where you are now.

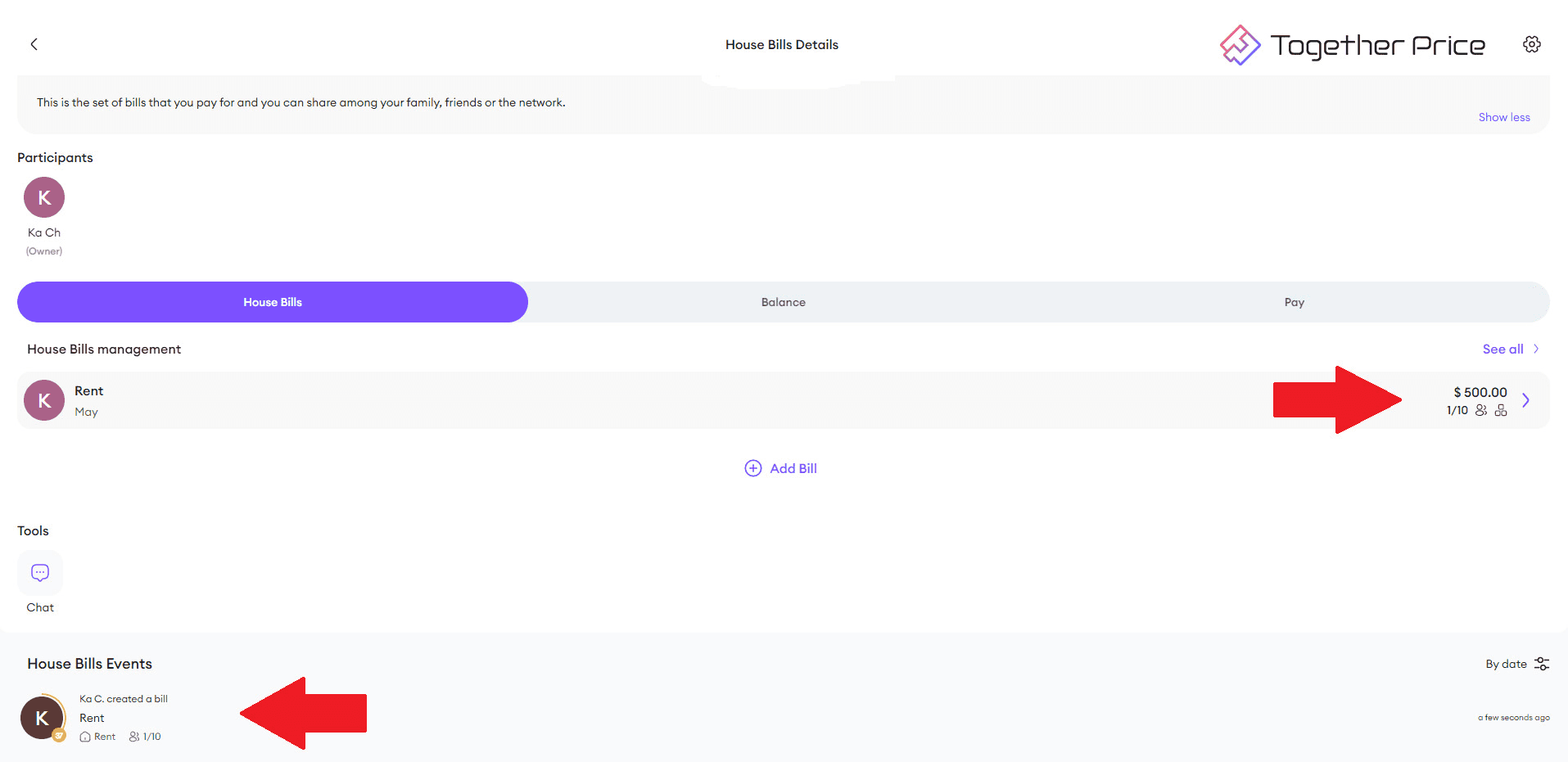

Use a Bill-Splitting App

To track your personal finances and easily calculate shared expenses you can use a bill-splitting app. Bill-splitting apps take all the stress out of managing and dividing shared bills. Not only does this help relationships, where you need to share expenses, run smoother, but it also allows you to track exactly where your money is going each month so that you can more easily create a budget.

For the best bill-splitting app out there download the Together Price app. This lets you track and divide shared expenses, as well as set up automatic monthly payments.

Together Price

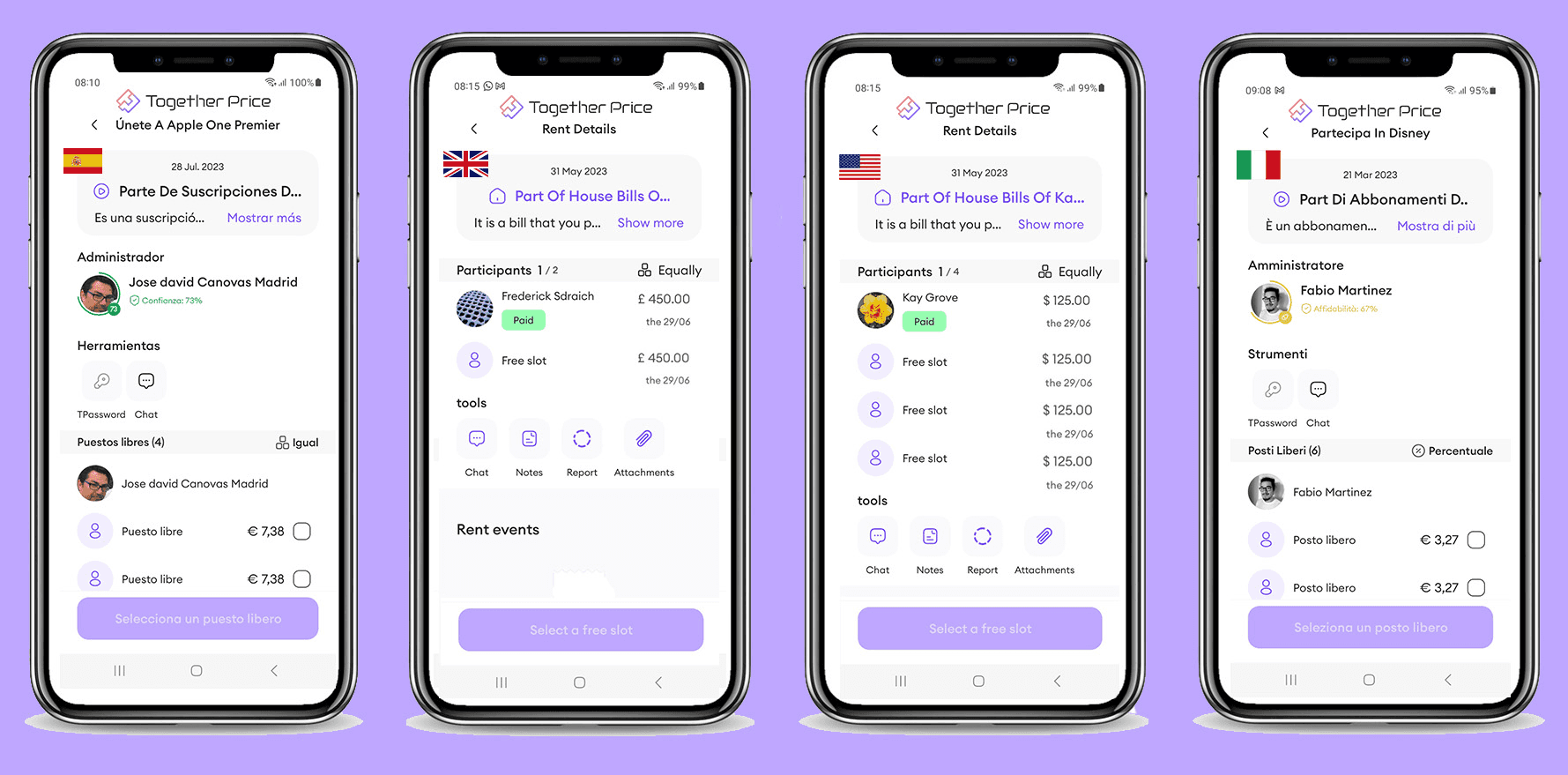

Together Price was the first worldwide app for sharing subscription costs. But now, with Together Price, you can do so much more. You can now share any kind of expense, from household bills to holidays, dinners, weddings, gifts, and more.

The Together Price app, on Android and iOS, is easy to use. All you need to do is sign up for free and make an account. Once you have done that you can create a group and add multiple members who are looking to share costs. This might be a household group, a family, or the group of people you are going on vacation with.

Once you have a group, all you need to do is create an expense. You can add expenses as you go. When you add an expense you can choose to add a photograph of the receipt and add exactly which members need to pay you back. You can choose to split the bill equally, alternatively, if one person needs to pay more you can add that it.

When you choose to settle the bill the other members of the group will be sent push notifications detailing exactly how much and to whom they owe money. They can pay this back using the integrated payment system on the app, or mark down that it has been paid back in cash. Whichever way, everyone can see that it has been paid back!

This takes all the stress and worry out of sharing finances, and gives you an easy way to track how much you have spent on all of your shared costs.

As an Owner

As a Participant

As a Participant, you will be invited to add yourself to an expense created by the Owner. By registering with Together Price, you can pay your share of the costs and keep track of your payments in a simple and secure way.

You can keep track of all your transactions, send messages to the participants in your group, and much more.

Start sharing all your costs on Together Price today, now on Android and iOS!

Summing Up

Trying to calculate the cost of living in different cities, or want to create your own personal budget? Whichever way, you will need to pay attention to the different costs and incomes listed. Using the 50/30/20 rule you can easily create a budget that will help you start saving and meeting all your financial goals.

Want to make sharing costs that much easier? Then sign up for the Together Price app for free on Android and iOS. This will help you track and split your monthly shared expenses so that you no longer need to stress about it. Let Together Price do all the hard work for you!