Knowing what you spend money on each month is very important when it comes to managing your money. If you know where your money is going you can create a monthly budget that gives you some wiggle room for saving and emergencies.

When sharing finances, for example with housemates or in a relationship, it can get difficult to calculate your monthly income and monthly budget. Especially if you don’t know how much you are expected to pay for shared expenses.

And that is where Together Price comes in. With Together Price you can easily calculate and split your monthly shared expenses. The new Together Price app, on Android and iOS, lets you track shared expenses, split them equally, and pay off informal debts to each other. This is the shared budgeting tool that everyone needs!

Start budgeting and sharing expenses with Together Price today!

Why is Budgeting Important?

Budgeting is important for so many different reasons. By tracking your monthly spending habits you are able to calculate exactly how much your gross income needs to be each month to pay for all the necessary payments in life and have some spare.

By creating a budget and consistently sticking to it you are able to work towards achieving financial goals such as putting a down payment on a house or debt repayment from paying off personal loans or student loans. This will allow you to build up savings and create an emergency fund. With an emergency fund in place, you can feel more relaxed when met with unexpected expenses of life, such as unplanned medical costs or surprise housing costs, or home repairs.

You can create financial health and stability if you start budgeting soon. You can build towards a future and make comfortable retirement plans, all by paying attention to your personal financial situation now.

How to Create Your Monthly Budget

So you know that taking a budgeting approach is useful? But how on earth do you go about calculating your monthly income, expenses and creating a good budget? Well, luckily for you there are a number of different financial apps and budgeting tools that can help you build savings and increase your financial health.

List Your Monthly Incomes

The most basic method to calculate your monthly budget is simply to list all of your monthly incomes and expenses.

Your monthly income should include all of your income including:

Your wage (only the take-home pay)

Social security

Child support

Additional income for instance payments from family.

Any regular income needs to be included. But make sure not to use your gross income, not including taxes, so you know the real amount of net income you have to play with.

Calculate and Categorise Your Expenses

Your monthly expenses should include everything you need to spend money on in a month including:

Health insurance

Monthly savings emergency fund

Credit card debt

Monthly spending on household needs and personal care

Debt repayment

Fixed expenses like utility bills

Car payments and car insurance

Property taxes

Cell phone costs

Public transportation

Other automatic payments

A good tip when trying to find out which monthly payments you regularly make is to use financial statements and your bank. Some banking apps now even help categorize your monthly spending into different categories.

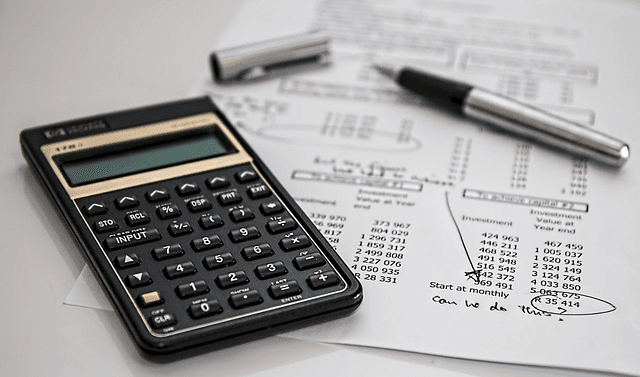

Use a Budget Calculator

If you don’t feel like doing all that work then you are in luck - simply find a free budget calculator. There are many different free budget calculator options available online now, making your budgeting process that much easier.

A budget calculator will ask you to input all of your different income and expenses into the calculator. After that, you will need to decide what your savings goal and emergency fund goals are. Your suggested budget will then be calculated based on the net pay and spending you’ve inputted into the calculator.

Most budget calculator options available will allow you to display your budget in an easy-to-read graph. This can really help you to understand where your money is going, where you can make budget cuts, and where your personal budget is working out for you.

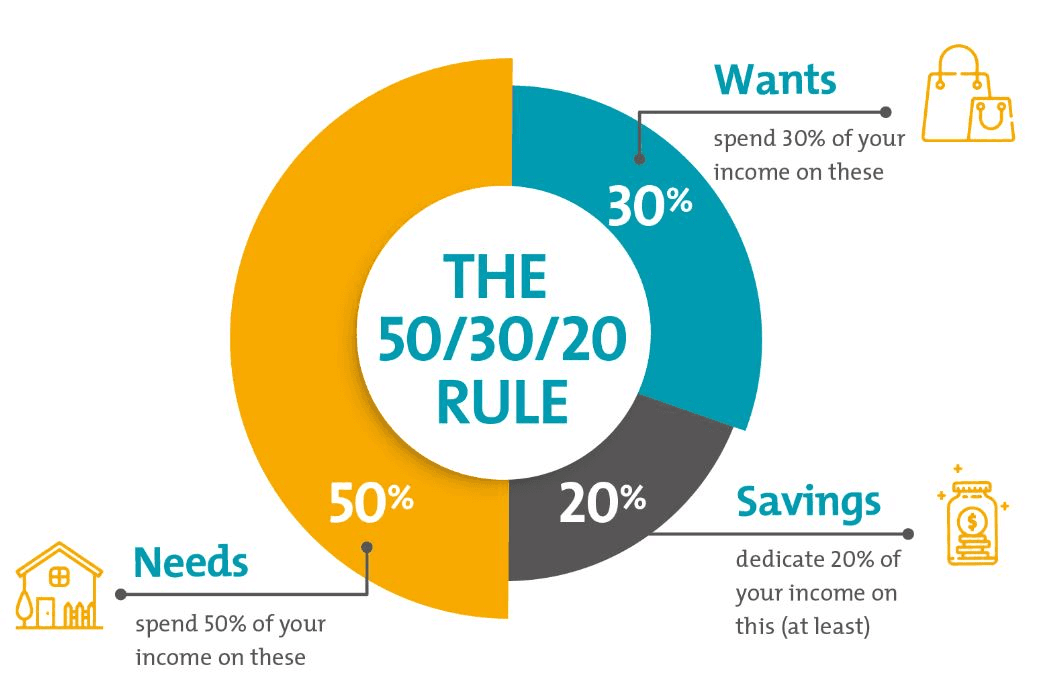

Use the 50/30/20 Rule

The 50/30/20 rule is a general rule for creating your own, financially stable, personal budget. This requires you to calculate your monthly net income, so basically, the money that you have free to use. And then based on that, you will place all of your spending into three categories.

The purpose of this is to categorize the areas where you can start spending less money and to be aware of exactly how much money is going out that cannot be cut down upon.

Using the 50/30/20 rule, you can build towards a stable future with savings and a retirement fund. This will help you to decide upon and meet your financial goals.

Of course, there are other ways to split your budget, it does not need to be an exact 50/30/20 split. But this is a general and helpful rule to base your spending and savings on so that you can have healthy finances and a good budget.

50% of Monthly Income: Needs

These are the expenses that you make that cannot be cut. They are the necessities and will include things like:

Your household budget including food and personal care items,

Housing costs such as rent, taxes, and bills,

Transport costs including your car payment and car insurance for car owners,

Debt repayment such as student loans or personal loans,

Insurance such as health insurance,

Any regular medical costs,

Child care or other expenses that you need to pay to be able to work.

30% of Monthly Income: Wants

It can be difficult to fully decide what fits as a want or a need. Some of these will change over time too. Generally, these are the extras that are not essential to living, working, and staying healthytext in bold.

You might find things such as travel, entertainment, meals out, and monthly subscriptions in this category. These are the things you really cannot live without.

20% of Monthly Income: Savings and Debt

This is the part of your income that you squirrel away as savings to prepare for the future. This can go into a number of different pots.

Creating a savings account can be a great way to save. These accounts often have a higher interest rate and allow you to have a separate place to keep your savings. This way you can really start saving money for a specific goal, for instance, for a new car, a house, or an upcoming trip.

It is also a sensible idea to budget for emergencies. With an emergency fund things like unexpected health care trips, repairs, oil changes, or other expenses you don’t expect, are manageable. This allows you to be comfortable with your budget and meet any unexpected costs with a sense of calmness.

The other savings fund that can be useful is to create a retirement fund. You can do this through a 401K or with an individual retirement account. Whichever way, paying into a retirement fund from a young age can really help you live a more comfortable retirement when the time comes.

How To Calculate Shared Expenses

When you live in a shared household, perhaps with a partner or simply with a housemate, it can make it difficult to calculate your monthly expenses.

Maybe you share grocery costs together, but you aren’t sure exactly how much the other person has paid, or perhaps the utility bills come out of their account so you don’t always know when these bills change. Whatever the reason, using a budget-sharing app can make your life a lot easier when sharing expenses.

What Does a Budget-Sharing App Do?

Split bill or budgeting-sharing apps let you easily share payments, both regular and one-off payments between multiple people.

Bill splitting apps let you create a group to share costs with, for instance, the household. Then everyone involved in that group can input their costs and the proportion of the payment due from each member of the group.

Many apps let users connect their bank accounts to the app and pay each member of the group back. You can often also mark when cash payments have been made. This way the whole group can stay on top of the shared costs.

By inputting your shared costs regularly into the app you are able to get a clearer image of how much your shared costs are, how much you need to pay other members of the group, and how much your overall costs are. This is all incredibly helpful when creating a monthly budget because it gives you a clear idea of your necessary monthly payments due.

Feel like a bill-splitting app would help you out? Then make sure to check out Together Price, the number one app to make sharing your expenses easier.

Together Price

Together Price was the first worldwide app for sharing subscription costs. But now, with Together Price, you can do so much more.

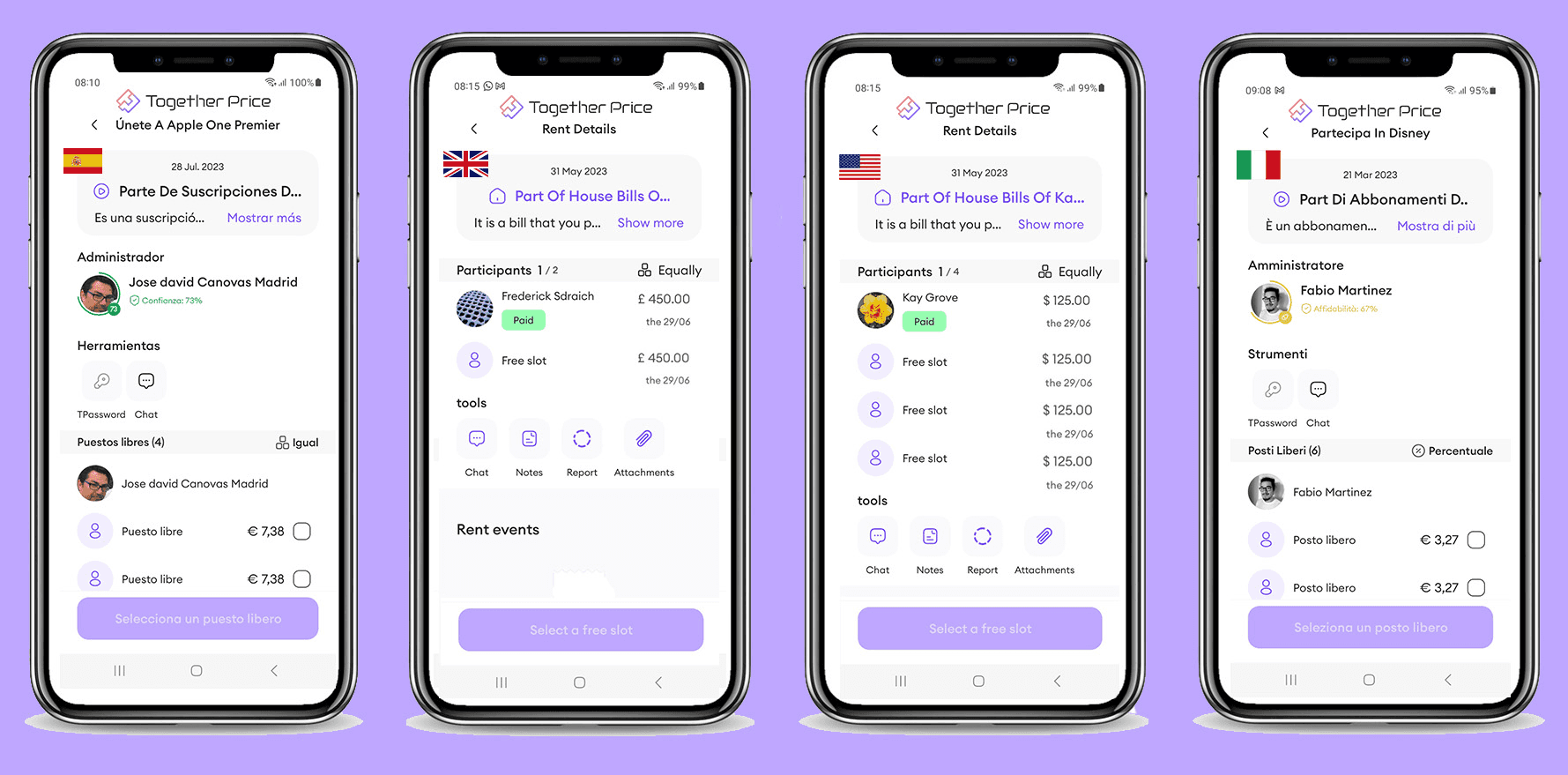

Together Price has a new feature that lets you share any kind of expense, from household bills to holidays, dinners, weddings, gifts, and more both on Android and iOS.

So if you don’t want awkward conversations about money with friends or family anymore if you want to keep on top of your household shared expenses and if you want to easily split your bills without having to do mental maths, then Together Price is for you!

What Can You Do on the New Together Price App?

The new Together Price app, on Android and iOS, has a range of different features, giving you the easiest way to share finances, save money and reach financial goals.

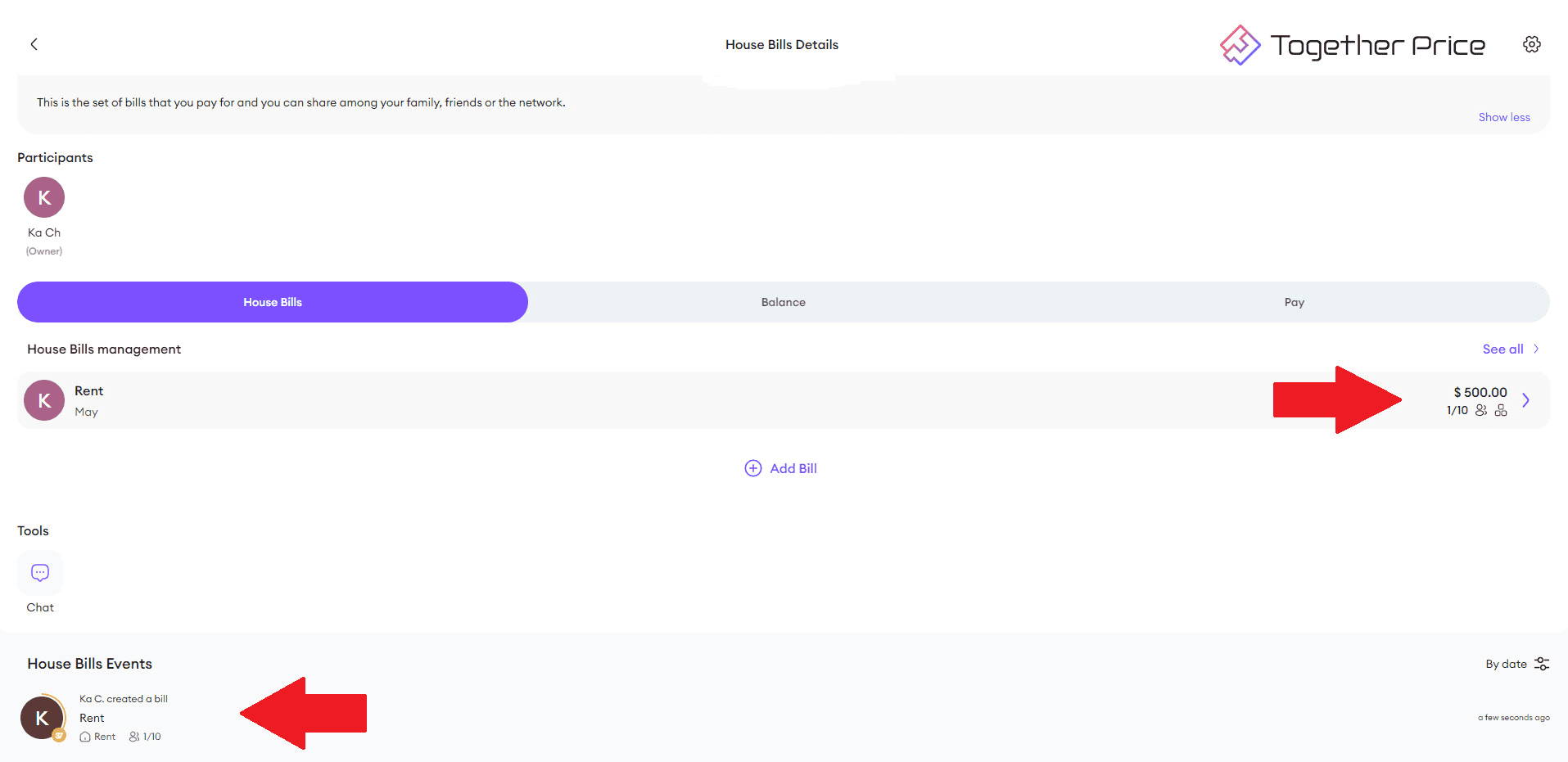

Using the Together Price app you can create groups and share group costs. You can even add a photo of the receipt so everyone knows which expense you are requesting money for.

You can share one-off payments on the app, or even set up automatic payments that are split monthly payments. This is a great option if you are splitting rent or other expenses like electricity bills.

The Together Price app lets you pay through the app or mark down any cash payments received so that you can always see if the informal debts have been prepared, and keep a clear track of finances.

On top of this, you can still use Together Price to share the costs of any subscription you can imagine, for example, Apple Music, Tidal, Audible, Disney Plus, HBO, and many, many more.

Together Price makes personal budgeting, saving, and sharing costs completely hassle-free.

As an Owner

As an Owner, you will create an expense to share. After registering to Together Price for free, simply create an expense and add the participants you want to share the cost with. Easy!

As a Participant

As a Participant, you will be invited to add yourself to an expense created by the Owner. By registering with Together Price, you can pay your share of the costs and keep track of your payments in a simple and secure way.

You can keep track of all your transactions, send messages to the participants in your group, and much more.

Start sharing all your expenses on Together Price today!

Summery

Creating a personal budget is the best way to gain financial stability and meet your financial goals. There are many different ways to go about doing this, but you will always need to calculate your income and expenses and create a realistic budget.

Luckily there are a lot of tools out there to help you calculate a budget, for instance, using an online budget calculator.

To make calculating and paying back shared expenses free from hassle, Together Price is the app for you. So sign up for free on Together Price today on Android and iOS, and you can start smashing out your financial goals and saving for your future!