Cost sharing refers to the health care costs covered by your health insurance plan paid out of pocket by the enrollees. You and your health insurance company will split the costs of your medical bills over the year.

Cost-sharing, cost-sharing subsidies, and other finances around the health insurance plan can be difficult to understand, which is why we are breaking down exactly how cost-sharing, out-of-pocket costs, and paying for medical care actually works.

Need to pay for regular prescription drugs, your health insurance plan, and other health care costs? It can be difficult to juggle all your payments. This is where budgeting can really help you keep on top of your health insurance costs.

To help your budgeting needs, splitting costs, and generally saving money try the Together Price app on Android and iOS This gives you an easy, hassle-free way to share expenses and start budgeting your finances to keep up with the premiums charged by health insurance plans.

What is Cost Sharing?

Almost all health insurance plans in the US require enrollees to pay a percentage of the costs when they medical services.

Using in-network providers the cost-sharing amounts might be lower as they are in the plan’s network. But using doctors and providers out of the plan’s network can cause the cost-sharing costs to be higher. Many plans even require enrollees to pay the full cost - this could even be higher for you than with an in-network provider.

Cost sharing comes in the form of deductibles, copayments, and coinsurance. The specifics of these depend on your health insurance company, the medical services you’ve received, and the health care premiums you are paying.

Generally, plans offered with ower premiums have higher cost-sharing costs, whilst those with higher premiums have lower cost-sharing costs.

Cost sharing is part of almost all the health insurance plans available in the US, from private health insurance to Medicaid plans. Admittedly Medicaid plans involve much lower cost-sharing payments and offer cost-sharing subsidies due to the low income of the enrollees.

Deductibles

The deductible is the amount of money you have to pay for health services before your health insurance plan will start to pay for covered services. These tend to be annual deductibles. Some health insurance plans will also have deductibles for things like prescription drugs or other services.

The cost of the deductible depends entirely on the health insurance company and the health plan you have chosen. The cost of the deductible can start at $0 to around $250-500, but it can also even be in excess of $5000.

When taking out health plans for a single individual or family, you will see the cost of the deductible. The deductible is a set cost at the beginning of the plan and is not a percentage of the healthcare costs. Once the deductible has been paid the insurance company will start paying at least a portion of the cost of your health services for covered services.

Out-of-pocket limits on Deductibles

The Affordable Care Act has set out-of-pocket limits on the cost of your deductible, as long as you are using a health insurance company that is regulated by the ACA. The out-of-pocket maximum for a deductible is $9,100 for a single individual plan. This changes each year.

Even once you have paid your deductible costs you might still have to pay copayments and coinsurance, depending on the coverage and terms of your health insurance plan.

Copayments

Copayments, also known as copays, are a set amount that you will be required to pay for certain services. These are generally smaller amounts, for example, $30 to see your doctor each time you need to use the service.

In some health plans copayments are not related to the deductible you have to pay. That means when you go to visit the doctor you will need to pay $30 regardless of whether you have finished paying your deductible. Depending on the healthcare services you use in that appointment you might also have to pay your deductible.

Other health care plans only require you to start paying copayments on things like prescription drugs once the prescription deductible has been paid off.

In all ACA-regulated health insurance plans the deductible and copayments will count towards the maximum out-of-pocket costs you can be asked to pay.

Coinsurance

Coinsurance is not a set amount when you take a health plan out. It is instead a percentage of the total amount your medical services cost. These usually only come into play once you have paid the entire deductible. Enrollees will be required to pay coinsurance until they reach the maximum out-of-pocket limits. Copayments and coinsurance do not apply to the same medical services.

The Affordable Care Act and Out-of-Pocket Costs

Unless they are grandmothered or grandfathered, all health insurance plans that have cost sharing, also have a maximum on the costs that a single individual can be responsible for. This is due to the Affordable Care Act.

The cost-sharing amounts and maximum out-of-pocket costs cannot be more than $9,100 in 2023. This out-of-pocket maximum changes each year due to inflation. This is the case for an individual whether they are covered by an individual health plan or are part of a family plan.

The out-of-pocket maximum limit can be a little higher when using medical care providers that are not in-network. But, as long as you are using in-network providers, paying your monthly premiums, and following the other rules, your health insurance company will continue to pay 100% of the coverage you need once you have reached the out-of-pocket maximum limit.

How to Budget to Use Healthcare Services

It’s no secret that the cost of health services and cost-sharing in the US is high. That is why, in order to make sure that you and your family have enough money to pay for any necessary health care, you need to have some sort of emergency fund and budget.

Realistically you need to make a monthly payment to cover the premiums of your plan, as well as be able to afford the deductible, copayments, and coinsurance required in your plan. That means you need a fairly big emergency fund. And what is the best way to achieve that goal? Make a budget!

Make a Budget

There are a few different ways to make a budget, but at the end of the day, you need to know exactly what you spend in a month, what you spend it on, and what your total income is. Once you know these things you just need to make one plan on how you will portion your money.

Using the 50/30/20 Rule

A good example of a general budgeting rule is to use the 50/30/20 rule. This requires you to categorize your income and expenses into three different categories. This will help you divide your money each month and see where you can cut down on spending.

50 % for Needs

Half of your income should go towards the things you need to live. This includes rent, utility bills, but also the cost of food, basic clothes, health care, and child care.

This includes things like your health insurance plan, Prescription ##### drugs and child care too!

30% for Wants

30% of your income should go towards your wants. It is not always easy to distinguish what counts as wants and needs. But generally, here you can think of things like going to the cinema, eating out, luxury items, etc. You do not need these things to live they are just nice to have!

20% for Savings

This is the important part when it comes to health care. This part allows you to put money away for the future, meet saving goals and prepare for unexpected health care costs. By saving 20% of your income you are likely to be able to cover the cost of unexpected illness and accidents if necessary.

Keep enough money aside for any unexpected out-of-pocket costs!

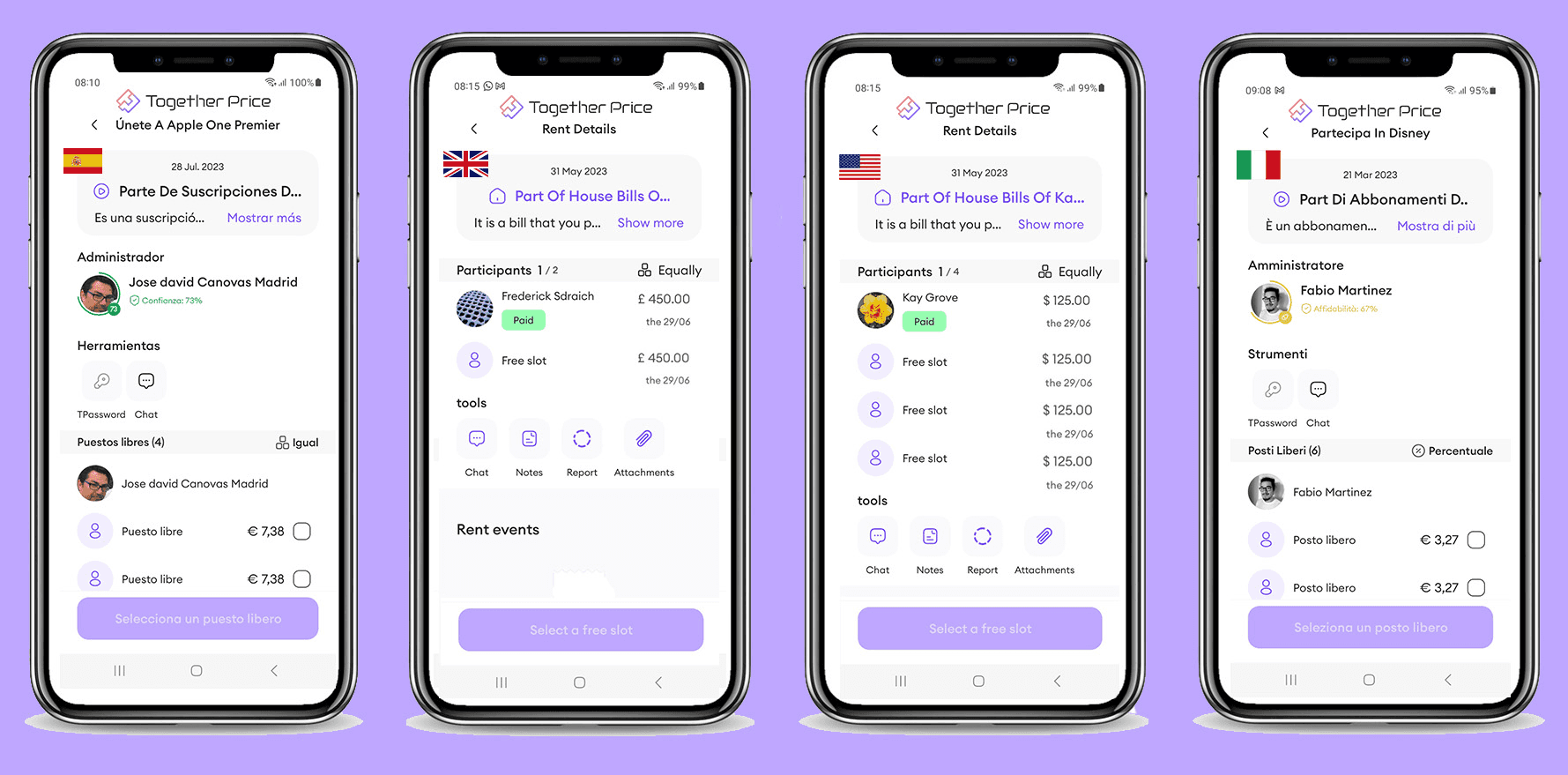

Use A Bill-Splitting App

It can be difficult to keep track of all the different expenses you have each month, particularly if you pay shared expenses, for instance by living with friends or going on a family or friends trip. It can also be hard to keep track of the money you have lent to others.

And that is where bill-splitting apps such as Together Price, come in.

They are incredibly useful budgeting tools because they allow you to track your shared expenses, request money back from friends and family, and even categorize where your shared payments went to.

By splitting bills equally and easily using bill-splitting you take the stress out of shared expenses with housemates, friends, and family, and make it easier to create a healthy budget, with room for unexpected health care costs.

Together Price

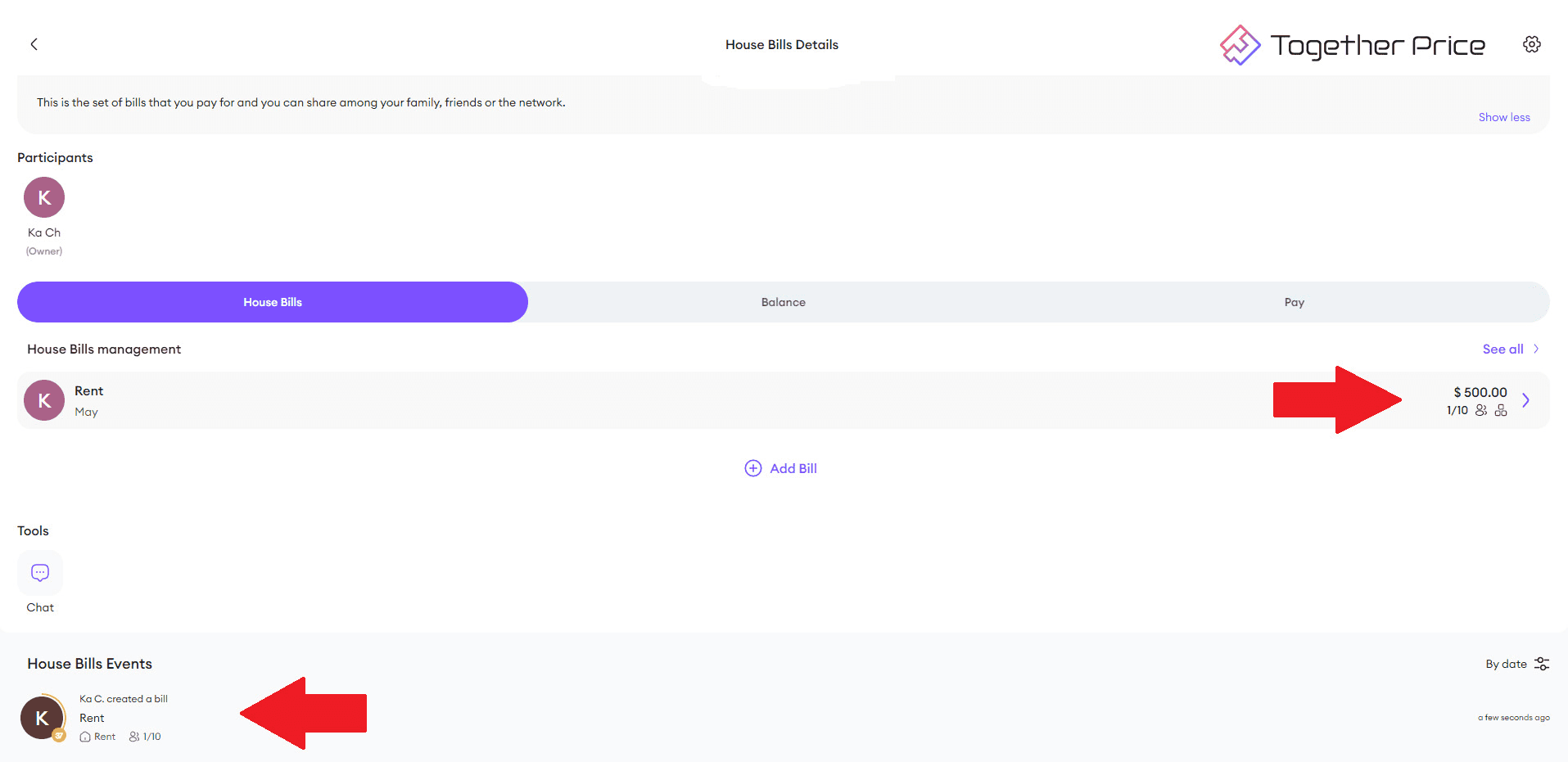

Together Price was the first worldwide app for sharing subscription costs. But now, with Together Price, you can do so much more. You can now share any kind of expense, from household bills to holidays, dinners, weddings, gifts, and more both on Android and iOS.

As an Owner

As an Owner, you will create an expense to share. After registering to Together Price for free, simply create an expense and add the participants you want to share the cost with. Easy!

As a Participant

As a Participant, you will be invited to add yourself to an expense created by the Owner. By registering with Together Price, you can pay your share of the costs and keep track of your payments in a simple and secure way.

You can keep track of all your transactions, send messages to the participants in your group, and much more.

Start sharing all your expenses on Together Price today!

Summing Up

Understanding the ins and outs of health care insurance can be tough. With all the differences between your deductible, copayments, and coinsurance it can be difficult to understand. But by understanding how this works and creating a good budget you will be more comfortable paying for health care, as well as more likely to be able to financially deal with unexpected illness or accidents.

To help with all your budgeting needs use Together Price now on Android and iOS. This bill-splitting app will take all the stress out of sharing expenses and calculating your monthly budget.