At some point in any relationship you have to start dealing with the elephant in the room: shared expenses. Whether these are the household expenses from living together, splitting expenses from dates, or making retirement plans, you and your partner will need to discuss money.

This can be quite awkward and difficult to negotiate, particularly if one partner has more money or one partner has student loans and must pay regular debt payments. So here are some of the most common ways that partners can decide to split expenses.

But luckily, nowadays there are easy tools available to help keep open communication about money and turn it into a smooth conversation.

If you are looking for an easy way to keep track of shared expenses without having a joint bank account, then Together Price is the app for you, now on Android and iOS.

Together Price lets you easily input, track, and split all your shared expenses so that both partners are on the same page.

How to Split Expenses with Your Partner

When you first decide to start splitting expenses with a partner, it can feel quite intimidating. Suddenly sharing rent, household expenses, and maybe even a joint checking account, can feel like a big commitment. However, there are many different ways to share expenses without having to straight away set up a joint credit card and a joint savings account. So here are the best ways to start managing money and sharing expenses in a relationship.

Make a Plan on How to Deal with Shared Expenses

The most important thing, when it comes to shared expenses is that you and your partner communicate openly about everything and make a plan.

You might have different personal expenses and different financial goals. Perhaps one person wants to have a higher grocery budget whilst the other person doesn’t want to pay for streaming services or have retirement goals. Whatever it is, when trying to take into account two people’s finances, you may have to come to a middle ground and compromise on some financial decisions.

When planning you will need to calculate your total household income as well as the total of the shared costs you are looking to split. For couples with individual accounts that are completely separate, you will need to decide exactly how to split expenses based on which logic.

Split Expenses Equally

Some couples choose to split expenses equally. Both partners contribute exactly half of all the shared costs and pay from separate accounts. This means both people pay the same percentage as each other and they have split finances directly between both involved parties so the burden of the costs falls equally on both partners.

Split Bills Based on Income

Other couples choose to try splitting expenses based on the different incomes of each person. If one partner’s income is higher, they will pay a higher proportion of the shared bills.

If the partner B has a lower income then it makes the most sense for them, following this logic, to pay a smaller portion of the monthly bills. This means you need to calculate the total shared expenses and split these based on the percentage decided on.

For example, this might mean that one partner in the relationship pays 70% of the rent, whilst the other person pays about 30% of the bills. The idea is that proportionally both partner A and partner B pay the same money.

How to Share Your Expenses

Once you have a plan set in place with your partner on how you will manage the shared expenses in your relationship and how much each person with contribute, you need to figure out practically how you will share bills.

There are various different ways in which you can practically manage shared finances. Most couples choose to use the below options.

Take it in Turns to Pay

Taking it in turns to pay, means one month one person pays, and the next month, the next person does. This allows both people in the relationship to keep their own personal accounts and keep their finances a little more separated from each other.

However, this does not work so well when trying to split bills such as rent or utility bills. These tend to be regular and automatic payments so it makes sense if they come out of one account.

It can also be difficult to keep track of who is paying for what when you take turns paying. It can easily turn into one person paying more without either person really noticing.

This works best for people who have a similar income to each other, carry their money around regularly, and pay attention to how much they are spending.

Create a Joint Account

An easier way of managing shared costs is to create a shared bank account. Whether you share a joint checking account or a credit card, having a joint account can be a great way to keep track of the bills, rent, and other things that have been paid.

Just because you have a joint account does not mean each person cannot also have their own separate bank accounts. It could be that you make a total household income that both partners have to contribute to, and this is put in the joint account. From that money pot, you can pay all the bills, and keep the rest of your income in your own personal account.

Use an Expenses Sharing App

The easiest way to keep track of your expenses, what needs to be paid, and to split bills equally or based on a set percentage, is to use an expense-sharing app. This lets you input and track all the payments you make, for example, the cost of the groceries or a meal out, as well as set up regular payments.

You can do this whether you have personal accounts or joint accounts, making it the ideal way to keep track of where your money goes each month.

Together Price is a top expense-sharing app that lets you share bills with no hassle at all. Sign up for free and you can share your bills with partners, family members, friends, and much more. Take money management out of your relationship by installing the Together Price app.

Together Price

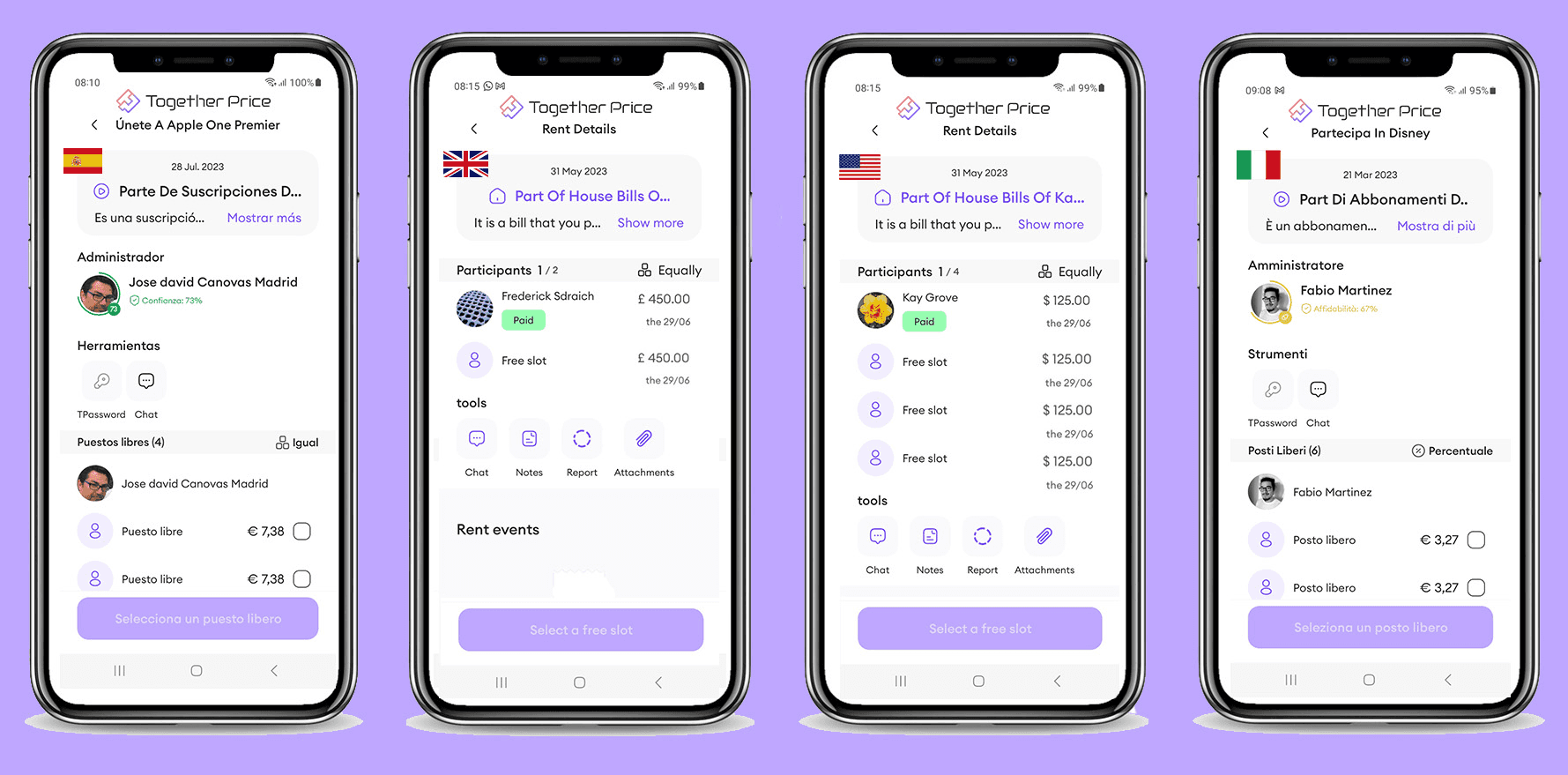

Together Price was the first worldwide app for sharing subscription costs. But now, with Together Price, you can do so much more. You can now share any kind of expense, from household bills to holidays, dinners, weddings, gifts, and more on Android and iOS.

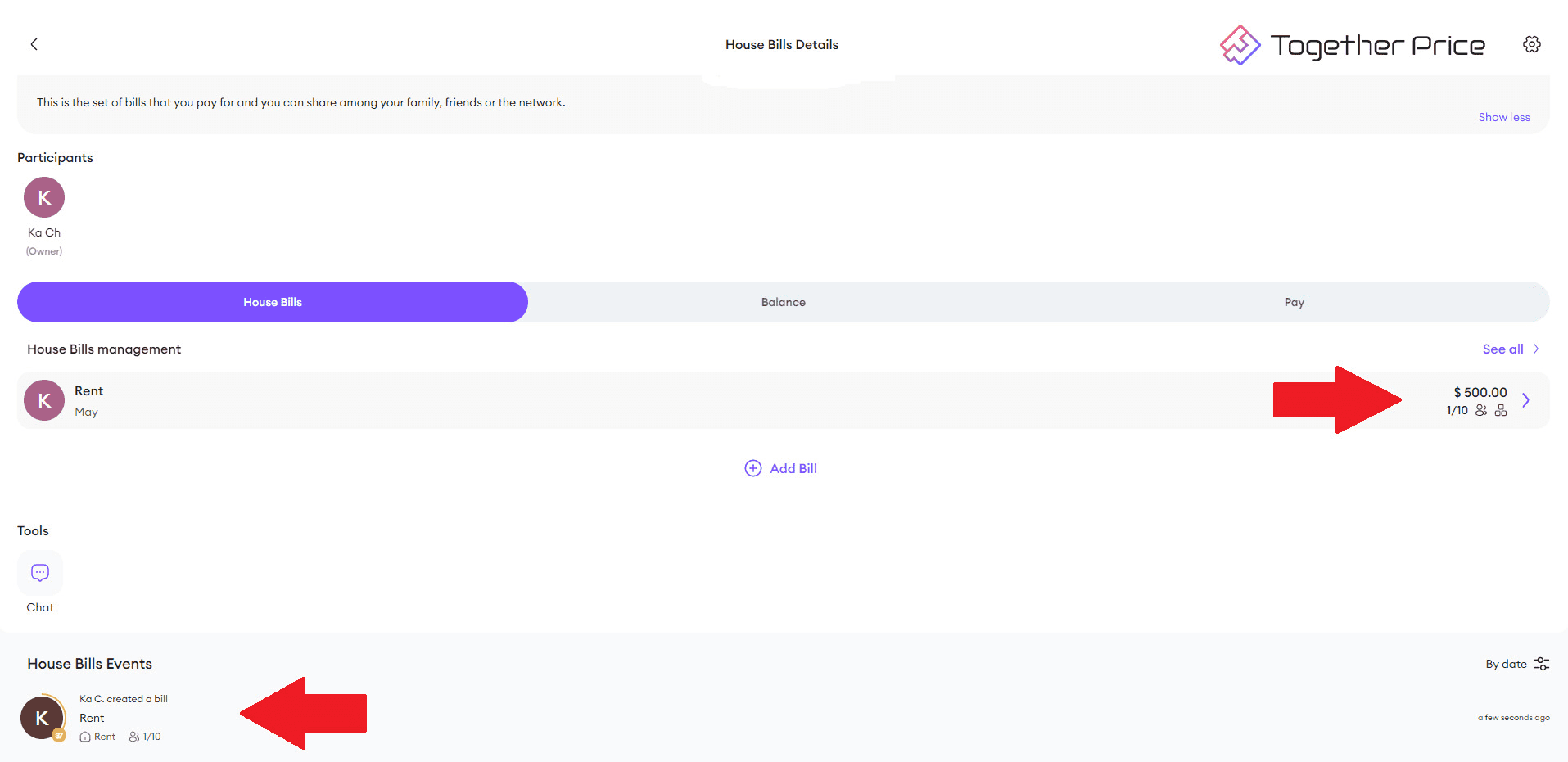

As an Owner

As an Owner, you will create an expense to share. After registering to Together Price for free, simply create an expense and add the participants you want to share the cost with. Easy!

As a Participant

As a Participant, you will be invited to add yourself to an expense created by the Owner. By registering with Together Price, you can pay your share of the costs and keep track of your payments in a simple and secure way on Android and iOS.

You can keep track of all your transactions, send messages to the participants in your group, and much more.

Start sharing all your expenses on Together Price today!

Summing Up

Managing money and splitting expenses in a relationship can seem like a scary thing to do. But there are many ways to make it easier, for example by creating a shared account. The number one way to simplify your shared finances is to use a bill-sharing app.

Together Price is a top bill-sharing app that lets you track expenses, share bills, and set up monthly payments. So what are you waiting for? Make money management easy and sign up for free for a Together Price account on the new Together Price app on Android and iOS.