There are many situations where you might need to share expenses with another person or group of people. For instance on group trips, in important relationships, such as roommates splitting rent and utility bills, couples sharing relationship costs or simply co-workers, friends and family splitting the restaurant bill or splitting travel expenses.

It can be difficult to split expenses equally and keep track of the informal debts between people. But, luckily, nowadays, there are apps made to simplify debts and split bills. These bill-splitting apps take all the stress out of shared expenses.

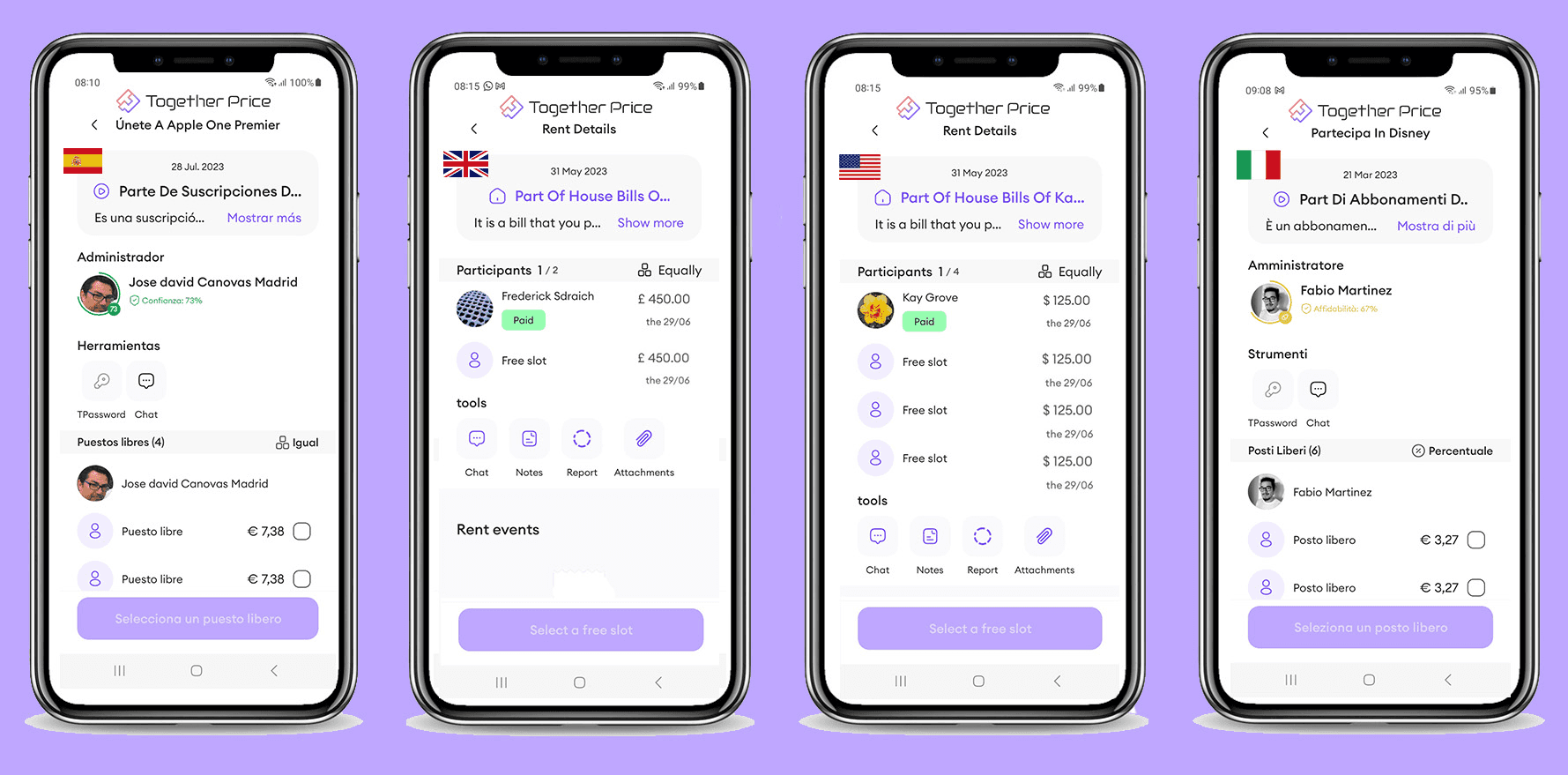

Together Price is a bill-splitting app for Android and iOS with industry-leading features and world-class customer support. This genius expense-splitting app makes dividing expenses easy and hassle-free.

Why Use an Expense-Sharing App?

Not sure why a bill-splitting app is one of the most useful budgeting tools out there? Then keep reading to see all the ways in which bill-splitting apps can make your life so much easier.

To Organize Group Bills

The broadest and most basic use of a bill-splitting app is to help organise group bills. To put it simply, on most apps you can create groups. These include everyone who is involved in that specific expense. You can add multiple payers to each group.

From there each user can create bills and assign exact amounts to different members of the group, or split bills equally between the entire group. Each of the group members can add expenses and add informal debts to the app.

These can often be added in different currencies and the app will automatically convert expenses to the correct currency.

The app will automatically split the total balances between the group members so everyone knows who and how much they need to pay back to settle any informal debts and shared expenses.

Users can choose to use integrated payments and connect their bank account to the app, alternatively, they can pay back with a cash payment.

For Rent and Apartment Bills

Bill-splitting apps are ideal for sharing the costs of rent and utility bills, as well as the other expenses that come with living in a household with multiple people. It can be difficult to track how much each individual spends on toilet rolls, cleaning supplies, food basics etc, but using an app you can keep track of this easily.

Simply add expenses to the house group on the app, and choose an interval to pay off the debts with the household. This will stop you needing to have awkward conversations about money with housemates, or living with the feeling that you are spending much more money on household items. Instead, you can focus on the other aspects of living together and potentially live together much more harmoniously.

For Recording Cash Payments

Keeping track of payments from bank accounts is difficult, but still doable. However, recording and keeping track of cash payments is next to impossible unless you are very organised. That means you can easily forget if you have paid someone back.

The great thing about bill-splitting apps is that you can keep a record of the cash you have paid to various different people. All you need to do is look through your expense history. This will let you see every single expense you have made with cash since using the app.

It can be a very helpful way to track where your cash has gone and involve that in a budget or when calculating your monthly expenses.

For Group Trips

Group trips are a lot of fun. But splitting bills and splitting expenses when travelling with friends and family is not. Not only do you need to split expenses related to transport costs and the vacation house, but you also need to take into account all the small costs - for instance the coffee under the Eiffel Tower, and the Spritz on the beach in Amalfi.

That is where bill-splitting apps can really help you out. All you need to do is create a group with everyone on the trip, add each expense as you go along, and finally, at the end of the trip choose to split the bill. The app will calculate group totals, and give push notifications to each user letting them know who and how much to pay.

The result of this is that you can keep private friendships and money separate. No one will need to feel like they are spending more, expenses will be transparent, and you don’t need to constantly think and talk about money.

To Split the Dinner Bill

At the end of a group meal, when everything is put on the same bill, there is often that awkwardly long conversation about how you plan on splitting expenses. To simplify debts some people might suggest just splitting the bill equally, but if you’ve had a tiny salad, whilst someone else ordered lobster, that can be a bit of a kick in the teeth.

Luckily, by using bill-splitting apps you can let the app do the maths for you, and enjoy the end of your meal without the awkward conversation about paying. Hooray for technology!

To Manage Recurring transactions

There are many instances where we have recurring transactions that we need to pay to people. For instance, when splitting the rent or utility bills, or when paying someone back for a share of a subscription service. Bill-splitting apps make this easy too.

All you need to do is set up your automated transaction, choose a term for it and get it started. You will never be late on a payment again and you won’t even have to think about it.

For Tracking Finances

The best way to meet your financial goals is to budget. By budgeting, you can build your savings, create an emergency fund for unexpected costs, and even plan for your retirement. But to be able to budget you need to know your monthly expenses. Whilst it is easy to work out your own personal, and private expenses, working out how much your shared expenses are is more difficult.

However, using a bill-splitting app you can easily track your finances. Not only can you upload receipts and store high-resolution receipts, but you can also see how much you are spending each month on the shared expenses in multiple groups.

To go even deeper into this, many bill-splitting apps offer expense categorization features. That means you can see exactly which categories the majority of your money goes to. You can even restore the information from a deleted group if it turns out you still need it.

Armed with this knowledge you are able to create a budget that helps you meet your financial goals.

Together Price

Together Price was the first worldwide app for sharing subscription costs. But now, with Together Price, you can do so much more. You can now share any kind of expense, from household bills to holidays, dinners, weddings, gifts, and more on Android and iOS.

Simply sign up for the free app available for both Apple and Android users, create your custom user avatars and start sharing your costs.

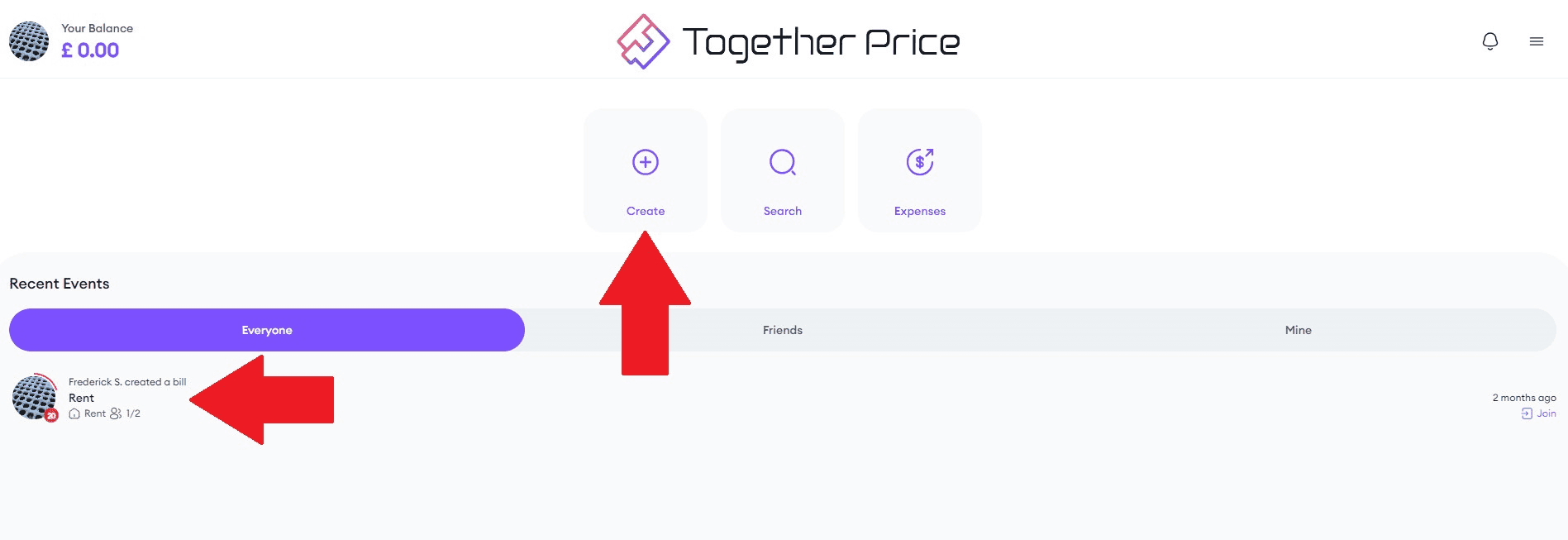

As an Owner

As an Owner, you will create an expense to share. After registering to Together Price for free, simply create an expense and add the participants you want to share the cost with. Easy!

As a Participant

As a Participant, you will be invited to add yourself to an expense created by the Owner. By registering with Together Price, you can pay your share of the costs and keep track of your payments in a simple and secure way.

You can keep track of all your transactions, send messages to the participants in your group, and much more.

Start sharing all your expenses on Together Price today!

In Summary

Using an expense-sharing app you can save all the hassle and stress around splitting bills in many different situations. This is one of the best budgeting tools out there and will simplify your finances hugely.

So what are you waiting for? Sign up for Together Price today on Android and iOS and start sharing!